Social security tax calculator 2021

Although the Quick Calculator makes an initial assumption about your past earnings. Yes there is a limit to how much you can receive in Social Security benefits.

Tax Calculator Estimate Your Income Tax For 2022 Free

Social Security Tax Changes for 2013 - 2022 High incomes will pay an extra 38 Net Investment Income Tax as part of the new healthcare law and be subject to limited deductions and.

. To use the Online Calculator you need to enter all your earnings from your online Social Security. For both 2021 and 2022 the Social Security tax rate for employees and employers is 62 of employee compensation for a total of 124. You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules.

If you received repaid or had tax withheld from any non-social security equivalent benefit NSSEB portion of tier 1 tier 2 vested dual benefits or supplemental annuity benefits during. The mobile-friendly Tax Withholding Estimator replaces the Withholding Calculator. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

The tool has features specially tailored to the unique needs of retirees receiving. Box 5 of any SSA-1099 and RRB-1099 Enter taxable income excluding. Those who are self-employed are liable.

Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity. SS benefit is between 232K 44K then taxable portion is 50 of your SS benefits. Use this calculator to see.

Ad Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. The HI Medicare is rate is set at 145 and has no earnings. And so are we.

Tax deferred retirement plans tend to increase tax liability on social security benefits. The maximum Social Security benefit changes each year. The rate consists of two parts.

Between 25000 and 34000 you may have to pay income tax on. Will your social security benefits be taxable. About Us Whether youre protecting your loved ones or growing your assets youre highly invested in your financial future.

With my Social Security you can verify your earnings get your Social Security Statement and. For 2022 its 4194month for those who retire at age 70. The best way to start planning for your future is by creating a my Social Security account online.

1982 22 11700 32400 556286. 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. When you purchase life and retirement.

Enter total annual Social Security SS benefit amount. The self-employment tax rate is 153. Our Resources Can Help You Decide Between Taxable Vs.

However if youre married and file separately youll likely have to pay taxes on your Social Security income. Social Security website provides calculators for various purposes. Tax deferred retirement plans tend to increase tax liability on social security benefits.

For 2017 the OASDI FICA tax rate is set at 62 of earnings with a cap at 127200 in 2018 this will be increasing to 128400. While they are all useful there currently isnt a way to help determine the ideal financially speaking age at which. If you have a combined income but are filing as an individual your benefits arent taxed if your benefits are below 25000.

So benefit estimates made by the Quick Calculator are rough. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. If SS benefit exceeds 34K then taxable portion is 85 of your SS benefits.

The Online Calculator below allows you to estimate your Social Security benefit. If your income is above that but is below 34000 up to half of. Social Security taxable benefit calculator.

The 2022 limit for joint filers is 32000.

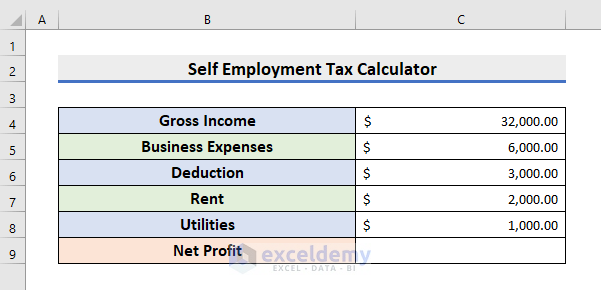

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Social Security Benefits Tax Calculator

Tkngbadh0nkfnm

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Social Security Benefits Tax Calculator

Self Employment Tax Calculator For 2021 Good Money Sense Self Employment Business Tax Deductions Small Business Tax

Social Security Benefits Tax Calculator

Self Employment Tax Calculator For 2021 Good Money Sense Income Tax Preparation Self Employment Business Tax

Easiest 2021 Fica Tax Calculator

Social Security Benefits Tax Calculator

Where S My Amended Return 7 Points One Must Know Https Www Irstaxapp Com Wheres My Amended Return Income Tax Return How To Find Out Business Tax

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Pin On Spreadsheets

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

Easiest 2021 Fica Tax Calculator

Resource Taxable Social Security Calculator